Really Simple Guide to Payment Gateways

Making ecommerce payments seamlessPayment Gateways are used as part of an ecommerce website to allow customers to pay using their credit and debit cards online. With what can seem like an endless list of options for Payment Gateway providers, let’s take a look through some of the popular ones.

Payment Gateways allow you to process card payments through your website without the technical headaches that often go with securely managing these transactions. By utilising a Payment Gateway this means that users’ credit card details are encrypted throughout their journey, so that information is passed securely between the customer, the merchant and the payment processor.

This Really Simple Guide to Payment Gateways aims to make this complex subject a little more accessible by allowing you to ask the right questions when making a decision. The reality of Payment gateways is anything but simple, so hopefully this guide will help to clear up a few misconceptions and outline some of the areas for consideration. Any Payment Gateway recommendations can vary enormously based on individual business requirements, so if you are getting lost in all of the options available, get in touch and we’ll help guide you through the world of Payment Gateways.

Security and PCI Compliance

In some instances with poorly implemented Payment Gateways, users credit card details can be exposed if the screen they are entering their credit card details on is not using SSL (the ‘HTTPS’ bit in your address bar). This is a serious security vulnerability if this happens as this means that anyone listening into the user’s internet connection (which is easier than most people think…) can see all the customer’s credit card information in plain text. Prime usage for criminals. If you are using any form of online Payment Gateways, please check that your implementation is set up correctly to avoid security issues or get in touch if you are unsure and we can take a look.

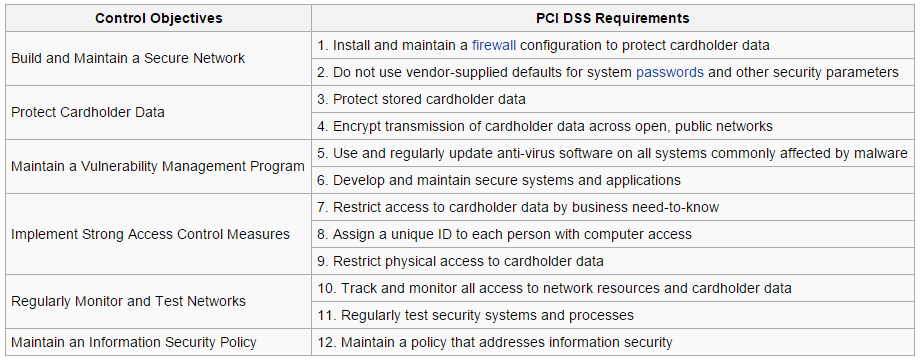

All forms of online transactions need to be PCI Compliant, meaning that they adhere to the 12 principles outlined below;

Failure to comply with the above can result in fines of up to £35,000. Hence the reason why it is generally a good idea to use a secure Payment Gateway, as they will be PCI compliant on your behalf so they take the headache away from you. This does not mean that you do not need to implement any security related measures though, depending on the technical implementation of your website, you may also need to be PCI compliant.

Payment Gateway Providers

There are many Payment Gateway providers available for you to choose. Many with different levels of charges per transaction, as a percentage of the transaction, as a monthly fee or a multiple of all of these. Following on from this, some Payment Gateways are much easier to integrate into website technology than others, which can be a deciding factor over which to use.

Looking over to the source of all knowledge, Wikipedia, which lists over 70 Payment Gateways, some of which are country specific: 2C2P, Adyen, Alipay, Amazon Payments, Atos, Authorize.Net, BIPS, BitPay, BPAY, Braintree (company), CentUp, Citibank, Creditcall, CyberSource, DataCash, DigiCash, Digital River, Dwolla, ecoPayz, Edy, Elavon, Euronet Worldwide, eWAY, First Data, Flooz, Fortumo, Google, GoCardless, Heartland Payment Systems, HSBC, iZettle, IP Payments, Klarna, Live Gamer, ModusLink, MPP Global Solutions, MultiSafePay, Neteller, Nochex, Ogone, Paymate, PayPal, Payoneer, Paymentwall, PayPoint, PayXpert, Payzone, Playspan, Popmoney, Realex Payments, Red Dot Payment, RuPay, Sage Group, Skrill, Moneybookers, Stripe (company), Square, Inc., TFI Markets, TIMWE, TransferWise, Ukash, V.me by Visa, VeriFone, Vindicia, WebMoney, WePay, Wirecard, Western Union, WorldPay, Xsolla.

Some of the above you will naturally have used yourself in the past when making payments online for products and services. Some of which you may never have heard of. There are other considerations particularly when you are looking to take your business international which will be covered a little later. It is important to check how the Payment Gateways stack up against your requirements and how well recognised are the Payment Gateways in the markets you are working in. All of these factors can have a significant impact on the choices you make and ultimately how successful or restricted your business becomes as a result of these choices.

How to Choose a Payment Gateway

There are many factors when deciding which Payment Gateway to use for your ecommerce website, here are a few handy questions to ask yourself;

- How well recognised is the Payment Gateway in your key markets? Some Payment Gateways are not recognised globally which could cause significant problems and cause customers in some markets to distrust the security of the online payment platform. On the positive, a well-respected Payment Gateway can help to increase the conversion rates for your ecommerce store.

- What countries and/or currencies does the Payment Gateway support? Many Payment Gateways aren’t global, so never make this assumption. Be aware of local currencies, currency exchanges and charges and other taxes that may be applied.

- How are the fees calculated per transaction? As a percentage, as a fixed fee per transaction, as a monthly fee, or a mixture of all of these? For smaller ecommerce retailers, this often isn’t a huge issue when you calculate the actual differences between providers. For larger ecommerce retailers, this clearly can result in much larger cost implications when choosing providers.

- What are your likely fees to be per month based on the expected transactions and sales through your website? The cheapest option may not be the best solution for a variety of reasons outlined here. Think about value, the value you are getting from the support documentation available for your preferred Payment Gateway, the functionality available through their system, the branding aspects and boosts to conversion rates.

- How easy can the Payment Gateway be integrated into your website or ecommerce platform? This should be, but often isn’t until later, a large factor to take into consideration. Some Payment Gateways are straight forward to implement (in comparison to the more difficult ones…) and some are extremely inflexible. As a prime example, you would have thought a Payment Gateway the size of PayPal would be flexible to implement custom solutions? It turns out that there are a few challenges when using a single PayPal business account for multiple websites, specifically related to how automated payments and Instant Payment Notifications are handled. When using a good ecommerce platform such as WooCommerce on WordPress or Magento, integrations are much easier with many popular plugins available for each. When using an ecommerce platform that isn’t quite up to scratch, then any form of Payment Gateway integrations are often a little more challenging, which is generally the case for any form of tweaks or integrations in general on those platforms.

- What anti-fraud measures are in place? Ecommerce fraud is a growing issue and is only going to get larger. Which is why there are services available to combat fraud. Selecting a Payment Gateway that provides maximum security for you as a seller can save you a lot of money in the long run. For example, it would be quite easy for someone to place an order using fraudulent card details, for you to dispatch the order before you realise that it was fraudulent and for you to be left footing the bill for the cost of those products. Most Payment Gateway providers will also offer real-time AVS/CV2 checks which checks the address and security code match what is on the account for that card. It is always worth checking that your chosen solution have as many security features as possible.

- What type of products do you sell? Some Payment Gateways will restrict the type of products and services that you can sell through their platform. For example, in high profile news a few years ago, PayPal stopped funding WikiLeaks, meaning that ecommerce payments supporting the group ended. For most businesses, this is unlikely to be an issue, although it is a consideration for businesses whose products and services could be seen as a little edgier or could be used in multiple ways. For example, speaking to a business recently who sells electronic equipment, the same item could be sold for use in either a fridge or in a tank, so they naturally had restrictions about where this product could and couldn’t be sold to. Each Payment Gateway generally has a list of prohibited items that are not allowed to be sold through the platform, so be sure to read through these carefully before making a decision.

- Hosted Payment Gateway or Integrated Payment Gateway? Most Payment Gateways offer either a hosted solution or an integrated solution. A hosted solution means that customers are taken off your website to the Payment Gateway providers’ website to enter their card details and process the transaction. An integrated Payment Gateway means that all of the transaction is handled on your website which can be fully branded to your individual needs. What this does mean though is that you need an SSL certificate for your web server so that all credit card details are handled securely and it is also important that if you are storing any sensitive data that you comply with PCI standards as outlined above. There are pros and cons for both options, which often depends on what you are aiming to achieve. An important point to note about either solution is that it is important that there is a final confirmation page on your website that a user lands on so that ecommerce tracking data can be sent through to Google Analytics to track orders effectively by traffic source and more.

- How soon will you be able to start accepting payments? Depending on the Payment Gateway you choose, some may get your account set up in no time so you can start accepting payments extremely quickly within a few hours. Others will require further validation such as postal security codes, payments into your bank account with security codes and more. As a rule of thumb, when choosing a Payment Gateway, don’t leave it until the last minute as you will have difficulties.

- Withdrawing funds, timescales and costs? Some Payment Gateways will hold funds in an account for you until you request a withdrawal. This is technically a merchant account, which is often bundled with your Payment Gateway provider. Depending on your Payment Gateway solution, they may charge you for withdrawing funds, they may set limits on the amount you can withdraw and they may delay payments for 30 days from the point at which you request a withdrawal. Something to bear in mind when selecting your provider.

- Added extras? Depending on the Payment Gateway solution you choose, you may have to pay added extra for certain features. For example, if you want to accept staged payments for a larger service, or subscription based services for services provided. Often, these types of payments are added extras from your Payment Gateway provider, so if these are important, ensure you review the full options before making a choice.

- Is it possible to integrate the Payment Gateway with your accountancy system? For many businesses, linking sales figures from multiple sources can be a challenge and quite a time consuming job. For example, if you are selling products through your website, through Amazon, through eBay, through other online market places, offline, through other online retailers and more. Managing this whole process can become a nightmare, which is why it would always be recommended to review the integration options. This isn’t a simple solution and often comes down to the website technology you are using, the Payment Gateway you are using and the accountancy system you are using. As with all technologies, linking systems together effectively often isn’t as straight forward as you would imagine, particularly when businesses are often using legacy technology or systems which may not have been built with this in mind. The digital world moves at a much faster pace than a lot of industries, so the concept of joining systems together is still a relatively new concept for many system providers, believe it or not! Thankfully with the advent of online accountancy systems, selecting the right website/ecommerce technology and choosing the right Payment Gateway, it is possible to integrate everything together into a seamless solution, meaning that sales figures, VAT, shipping, inventory management, stock control systems, product line analysis and more can all be integrated to provide you with a true picture of how your business and ecommerce website is performing. Throw away those CSV downloads and Excel spreadsheets, let technology do the hard work for you.

- How are refunds processed? Can refunds be processed through your website, or does this require some form of manual intervention through the Payment Gateways account system?

Global Payment Gateways

Briefly mentioned above was around the different requirements when operating on a global scale. The beauty of the internet is that you can sell your products and services globally without the traditional barrier to entry. This in itself also causes a few challenges often related to the legalities of trading in different countries, VAT and tax rules per country, shipping calculations along with any product restrictions per country.

Getting the Payment Gateway correct as part of your international growth strategy is only part of the solution, there is a wider solution required technically on the website and throughout your whole businesses to ensure you are capable of trading in multiple countries effectively. Assuming that everything else is in place (or being worked on…), here is a quick overview of the global Payment Gateways marketplace;

- Global:net, 2Checkout, Payza, WorldPay, Wirecard, MiGS , AlliedWallet, FirstData, Skrill

- Europe;

- Bulgaria:bg

- Croatia: PayWay

- Europe Wide: CertoDirect, PayPoint, Ogone

- Finland:fi, Suomen Verkkomaksut

- France: Atos, CM-CIC

- Germany: Sofort, NETBANX, Barclaycard ePQD, Wirecard, Ogone, WorldPay – Most of which accept ELV Payments, the main payment method in Germany

- Ireland: Realex

- Italy: Gestpay, Postepay

- The Netherlands: iDEAL

- Northern Europe: Klarna

- Poland: Przelewy24, PayU.pl

- Portugal: IfMB

- Romania:ro (GECAD ePayment)

- Russia: WebMoney, Robokassa, QIWI, Onpay, Yandex

- Scandinavia/Denmark:dk, DIBS

- Spain: ServiRed

- Sweden: Certitrade, Payson

- UK: SagePay, Cardstream, GoCardless, SecureTrading, eWay.co.uk, 2Checkout, Authorize.net, Braintree, CyberSource, DataCash, GoCoin, IATS Payments, Nochex, Optimal Payments, Payment Express PxPay, PaymentExpress, PaymentSense, PAYMILL, PayPal Express Checkout, PayPal Website Payments Pro, PayVector (formerly Iridium), Realex, SagePay Form, SOFORT Banking, WorldPay

- Asia;

- Asia: PayDollar

- China: Alipay, Tenpay, 99bill

- India:in, CCAvenue

- Japan: Zeus, Remise, Paygent, Epsilon

- Malaysia: iPay88, MOLPay

- Middle East: CashU

- Philippines: PesoPay, PayEasy

- Thailand: SiamPay

- Oceania;

- Australia: eWay AU, NAB Transact, e-Path, SecurePay, Merchant Warrior

- New Zealand: eWay NZ

- Oceania: ANZ eGate

- Africa;

- South Africa: PayFast, MyGate, VCS, WebCash, Netcash

- South America;

- Argentina: MercadoPage

- Brazil: MoIP, PagSeguro, Pagamento Digital

- Colombia: PagosOnline

- Latin/South America: DineroMail

- North America;

- Canada: Beanstream, Moneris, Stripe

- The Virtual World: BitCoin,

- Mobile Payments: SmsCoin

The above list is clearly not exhaustive by any means and does not take into account the varied payment methods in different countries such as online, offline, cash-on-delivery, sms payments and more. When looking to truly break into a new international market, a much more detailed international expansions strategy is needed. If you need help with this, get in touch and we can talk you through some of the projects we’ve worked on in this area previously. Shopify have a nicely curated list of Payment Gateways per country, although this is specific to what is possible to integrate with their technology, rather than which are the most popular in each market.

Summary

Selecting the right Payment Gateway for your business is tough. Make the wrong decision and this will cause you a lot of headaches, cost you a lot of money and hinder the progress your business can make when selling products and services online. We have a lot of experience with Payment Gateways, international markets, ecommerce systems, integrations and more. To discuss your individual needs, get in touch and we can guide you through the process to achieve your business goals and ambitions.